TradeOnOrion incident analysis

On May 28, 2024, the Orion project was exploited, resulting in a loss of approximately $645,000 at the time of writing. Let’s examine the details of how this attack took place.

Overview

Attacker address: https://bscscan.com/address/0x51177db1ff3b450007958447946a2eee388288d2

https://bscscan.com/address/0xf7a8c237ac04c1c3361851ea78e8f50b04c76152

Attack contract: https://bscscan.com/address/0xf8bfac82bdd7ac82d3aeec98b9e1e73579509db6

Victim contract:

https://bscscan.com/address/0xc662cea3d8d6660ca97fb9ff98122da69a199cd8

Attack transactions: https://bscscan.com/tx/0x660837a1640dd9cc0561ab7ff6c85325edebfa17d8b11a3bb94457ba6dcae18c

Prepare transactions:

ExchangeWithGenericSwap implements a token exchange and staking platform. User can deposit balance to stake or transfer by calling lockStake or doRedeemAtomic functions. Specifically, with the transfer function, users can defer liabilities without affecting the amount of tokens being staked as long as the liabilities does not exceed the total balance.

Exploit analysis

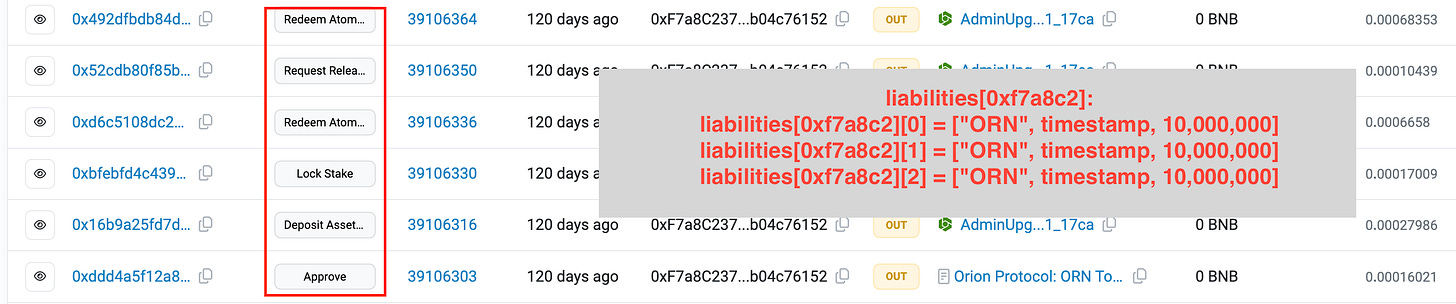

The attack appears to have followed a straightforward pattern: the attacker meticulously manipulated the liabilities array of an account which has address 0xf7a8c237ac04c1c3361851ea78e8f50b04c76152 through a series of preparatory transactions.

First, he deposited 10,000,000 ORN into the account and called the lockStake function to lock and stake the tokens, which reduced the assetBalances value to 0.

After that, he used the redeemAtomic function to transfer the same amount of ORN to another controlled account called B. This function allows users to incur liabilities when transferring tokens through the setLiability mechanism. When a user transfers an amount of tokens larger than their asset balance, the system checks if they have sufficient balance and authorization to deposit the required amount of tokens. If the balance remains less than 0, the system sets a liability for that user. This mechanism is ensured by the system’s check, which calculates the total balance, including collateral assets and liability assets.

Returning to the real case, the attacker transferred from 0xf7a8c237ac04c1c3361851ea78e8f50b04c76152, which had a balance of 0. As a result, the system set a liability for this address with an amount of 10,000,000, causing the account’s balance to become -10,000,000.

In the next step, the attacker called requestReleaseStake to withdraw all the staked tokens and added those tokens to the balance of 0xf7a8c237ac04c1c3361851ea78e8f50b04c76152, bringing this account’s asset balance back to 0. He then called redeemAtomic once more to transfer an additional 10,000,000 ORN to the B address. This action manipulated the liabilities array of 0xf7a8c237ac04c1c3361851ea78e8f50b04c76152 to contain two elements with the same value: ["ORN", timestamp, 10,000,000].

The attacker deposited an additional 20,000,000 ORN and repeated all the steps once more. At this point, the liabilities array of 0xf7a8c237ac04c1c3361851ea78e8f50b04c76152 contained three elements: ["ORN", timestamp, 10,000,000], while the asset balance of this account was only -10,000,000.

With a manipulated liabilities array, the attacker used PancakeSwap’s flash loan to transfer a large amount from account B back to 0xf7a8c237ac04c1c3361851ea78e8f50b04c76152. This caused the balance to change from -10,000,000 to approximately 1.96 million. Combined with the earlier information, the exploiter could borrow more assets from the system than they deserved. The attacker then used the redeemAtomic function again to transfer tokens to the attack contract.

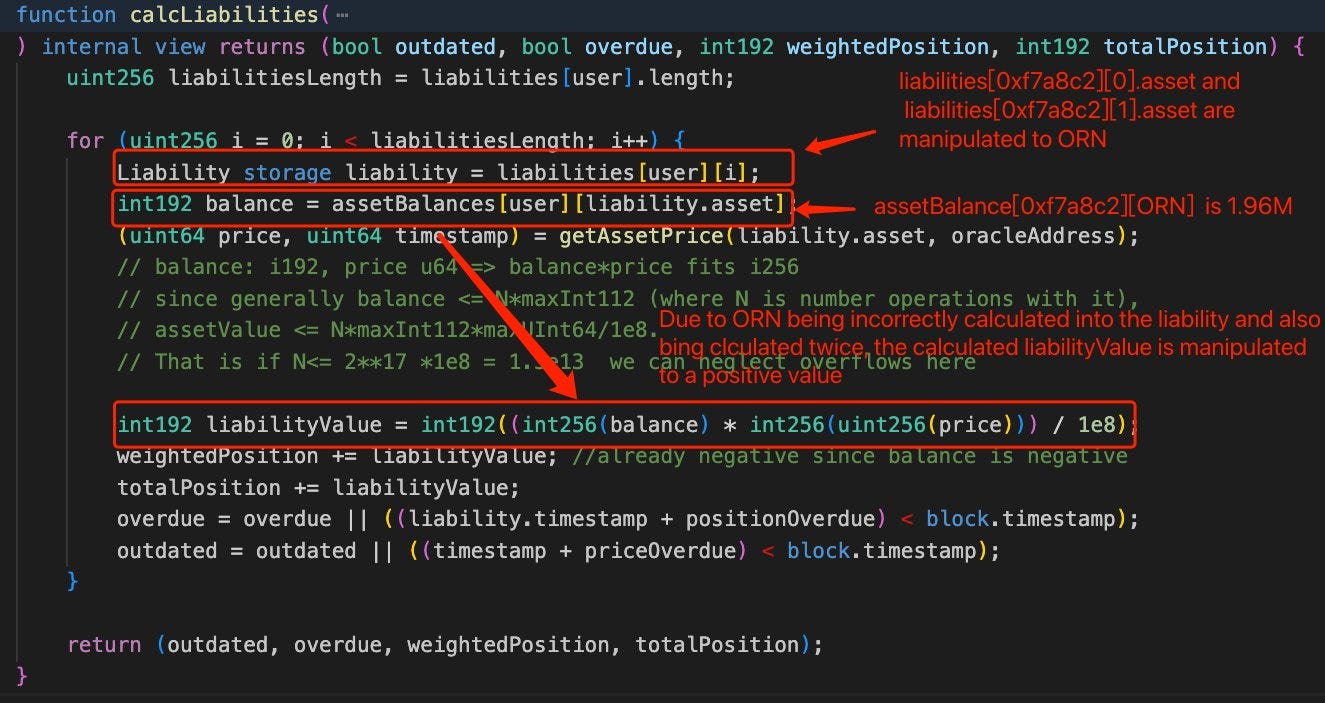

As mentioned above, there is a checking mechanism to ensure that the total balance of the user (including asset balance and staking balance) minus the liability balance must be greater than 0.

The system first calculates the user’s asset balance through the calcAssets function. After that, it calls calcLiabilities to sum all of the user’s liabilities and calculates the final state by performing a subtraction of those values. Only a POSITIVE state can be accepted to transfer tokens.

Since the user’s asset balance was approximately 1.96 million and the liabilities array still existed, the value of liabilityValue, which was supposed to be negative, became positive. Therefore, the attacker could bypass the health check mechanism when borrowing other tokens. Additionally, by manipulating the liabilities array, the attacker could borrow a greater value of tokens.

He used this attack pattern to transfer and withdraw approximately $645,000 in ORN, BNB, BUSD-T tokens, and others.

After the exploit, the attacker sent back the loan borrowed from the PancakeSwap flash loan.

Root cause

The root cause of the vulnerability is that the victim didn’t manage liabilities correctly. Liabilities must be updated when the user’s asset balance changes. However, in requestReleaseStake, the failure to update the liabilities for a user when releasing assets is a key factor contributing to this exploit.

In addition, the system should check if a user has different liabilities for the same token when updating or removing liabilities.

Conclusion

In conclusion, the lack of effective control over liabilities during the balance update process can lead to significant financial discrepancies and user dissatisfaction. It is essential to implement robust controls that monitor and manage liability levels in real-time, ensuring that users maintain a sustainable balance and preventing financial instability within the platform. By addressing these concerns, we can foster a more secure and trustworthy environment for all users.